IBM Cloud (formerly IBM Bluemix and IBM SoftLayer)

What is IBM Cloud?

IBM Cloud is a suite of cloud computing services from IBM that offers both platform as a service (PaaS) and infrastructure as a service (IaaS).

Why is IBM Cloud used?

With IBM Cloud IaaS, organizations can deploy and access virtualized IT resources -- such as compute power, storage and networking -- over the internet. For compute, organizations can choose between bare-metal or virtual servers.

With IBM Cloud PaaS -- which is based on the open source cloud platform Cloud Foundry -- developers can use IBM services to create, manage, run and deploy various types of applications for the public cloud, as well as for local or on-premises environments. IBM Cloud supports various programming languages, such as Java, Node.js, PHP and Python and extends to support other languages.

IBM Cloud products and services

IBM Cloud platform supports access to other IBM tools and services -- including IBM Watson and IBM Cloud Functions for serverless computing -- as well as those from third-party vendors.

IBM Cloud features

There are a number of IBM cloud services that are a part of the IBM cloud. These services are grouped into 16 categories:

- AI/machine learning: A collection of Watson-based AI resources and tools for building your own AI models.

- Automation: Automation resources enable business workflows to be automated using IBM Cloud Pak. Turbonomic is also available as an automation resource and can be used for application resource management and cost optimization.

- Containers: IBM offers its own cloud Kubernetes service, as well as access to the container registry, Red Hat OpenShift and Istio (a server mesh for microservices).

- IBM Cloud Paks: IBM Cloud Paks are applications that are certified for use on Red Hat Open Shift. Cloud Paks exist for business automation, data, integration, network automation, security and Watson.

- Quantum: Provides the ability to run workloads on quantum systems through IBM Quantum composer, the IBM Quantum Lab and the Qiskit SDK.

- Compute: Offers various compute resources, including bare-metal servers, VMs and serverless computing on which enterprises can host their workloads.

- Networking: Provides cloud networking services, such as a load balancer, a content delivery network, VPN tunnels and firewalls.

- Storage: IBM's cloud storage offerings include object, block and file storage for cloud data.

- Logging and monitoring: Provides tools to log, manage and monitor cloud deployments, including Cloud Activity Tracker, Cloud Log Analysis and Cloud Monitoring.

- Security: Includes services for activity tracking, identity and access management and authentication.

- Databases: Provides a variety of SQL and NoSQL databases, as well as data querying, warehousing and migration tools.

- Analytics: Offers data science tools such as Apache Spark, Apache Hadoop and IBM Watson Machine Learning, as well as analytics services for streaming data.

- Internet of things (IoT): Includes the IBM IoT Platform, which provides services that connect and manage IoT devices, and analyzes the data they produce.

- Developer tools: Includes a CLI, as well as a set of tools for continuous delivery, continuous release and application pipelines.

- Blockchain: Provides IBM's Blockchain Platform, a SaaS offering to develop apps, enforce governance and monitor a blockchain network.

- Integration: Offers services to integrate cloud and on-premises systems or various applications, such as API Connect, App Connect and IBM Secure Gateway.

IBM Cloud deployment models

IBM offers three deployment models for its cloud platform:

- Public: A public cloud that provides access to virtual servers in a multi-tenant environment. An enterprise can choose to deploy its applications in one or multiple geographical regions.

- Dedicated: A single-tenant private cloud that IBM hosts in one of its data centers. An enterprise can connect to the environment using a direct network connection or VPN, and IBM manages the platform.

- IBM Cloud Private: A version of the IBM platform that an organization deploys as a private cloud in its own data center behind a firewall.

IBM Cloud pricing

The exact cost of IBM Cloud varies depending on resource usage, deployment model, support and other factors. As of 2022, IBM offers two main pricing models. Those who signed up for a lite account prior to October 25, 2021 are able to keep that account, but all new accounts are automatically created as pay-as-you-go plans.

IBM's pay-as-you-go accounts are based on monthly consumption. IBM bills its subscribers based on the resources that they use.

The other type of account that is available is a subscription account. A subscription account is similar to a pay-as-you-go account but require organizations to commit to a minimal amount of spending. IBM offers discounted pricing for its services based on the monthly spending commitment, with larger commitments earning bigger discounts.

To better estimate costs, organizations have access to the IBM Cloud pricing calculator.

For more on public cloud, read the following articles:

Public vs. private vs. hybrid cloud: Key differences defined

Choose the right on-premises-to-cloud migration method

Breaking Down the Cost of Cloud Computing

Top 10 cloud computing careers of 2023 and how to get started

IBM Cloud rebranding and competitors

In 2013, IBM acquired SoftLayer, a public cloud platform, to serve as the foundation for its IaaS offering. In October 2016, IBM rolled the SoftLayer brand under its Bluemix brand of PaaS offerings, giving users access to both IaaS and PaaS resources from a single console. In October 2017, IBM then rebranded its entire cloud portfolio as IBM Cloud.

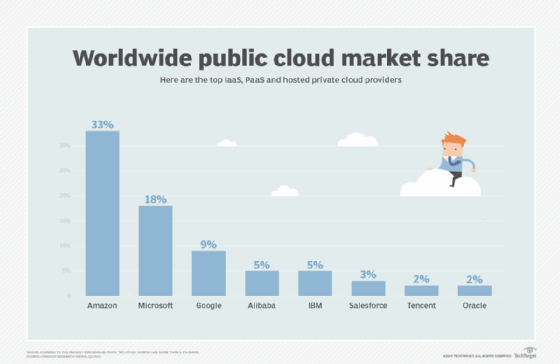

IBM's main competitors in the cloud computing market include AWS, Microsoft Azure and Google Cloud Platform.