multi-cloud strategy

What is multi-cloud strategy?

A multi-cloud strategy is the use of two or more cloud computing services. While a multi-cloud deployment can refer to any implementation of multiple software as a service (SaaS) or platform as a service (PaaS) cloud offerings, today, it generally refers to a mix of public infrastructure as a service (IaaS) environments, such as Amazon Web Services and Microsoft Azure.

Redundancy and vendor lock-in concerns drive many multi-cloud deployments today, but they are also being driven by business and technical goals. These goals can include the use of more price-competitive cloud services or taking advantage of the speed, capacity or features offered by a particular cloud provider in a particular geography.

In addition, some organizations pursue multi-cloud strategies for data sovereignty reasons. Certain laws, regulations and corporate policies require enterprise data to physically reside in certain locations. Multi-cloud computing can help organizations meet those requirements, since they can select from multiple IaaS providers' data center regions or availability zones. This flexibility in where cloud data resides also enables organizations to locate compute resources as close as possible to end users to achieve optimal performance and minimal latency.

Common uses for multi-cloud computing

Initially, many organizations pursued a multi-cloud strategy because they were uncertain about cloud reliability. Multi-cloud was, and still is, seen as a way to prevent data loss or downtime due to a localized component failure in the cloud. The ability to avoid vendor lock-in was also an early driver of multi-cloud adoption.

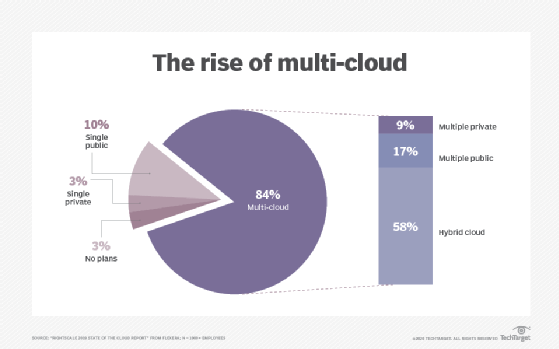

Multi-cloud adoption trends

A multi-cloud strategy also offers the ability to select different cloud services or features from different providers. This is helpful, since some cloud environments are better suited than others for a particular task.

For example, a certain cloud platform might handle large numbers of requests per unit time, requiring small data transfers on the average, while a different cloud platform might perform better for a smaller number of requests per unit time involving large data transfers. Some cloud providers also offer more big data analytics tools or other specialized capabilities, such as machine learning, than their competitors.

The pros and cons of a multi-cloud strategy

There are several commonly cited advantages to multi-cloud computing, such as the ability to avoid vendor lock-in, the ability to find the optimal cloud service for a particular business or technical need, increased redundancy, and the other beneficial uses mentioned above.

However, there are some potential drawbacks. For example, most public cloud providers offer volume discounts, where prices are reduced as customers buy more of a particular service. It becomes more difficult for an organization to qualify for those discounts when it doesn't concentrate its business with a single cloud provider.

In addition, a multi-cloud deployment requires an IT staff to have multiple kinds of cloud platform or provider expertise. Workload or application management in multi-cloud computing can also be a challenge, as information moves from one cloud platform to another.

Multi-cloud computing vs. hybrid cloud computing

Multi-cloud and hybrid cloud computing are similar, but different IT infrastructure models.

In general, hybrid cloud refers to a cloud computing environment that uses a mix of an on-premises, private cloud and a third-party, public cloud, with orchestration between the two. An enterprise often adopts hybrid cloud to achieve a specific task, such as the ability to run workloads in house, and then burst into the public cloud when compute demands spike.

Multi-cloud computing, as noted above, commonly refers to the use of multiple public cloud providers, and is more of a general approach to managing and paying for cloud services in the way that seems best for a given organization.

However, multi-cloud doesn't preclude hybrid cloud, and a hybrid cloud could be part of a multi-cloud deployment. The two models are not an either/or situation; it simply depends on what a business hopes to achieve.

Common vendors used in multi-cloud computing

There is no single multi-cloud infrastructure vendor. Instead, a multi-cloud strategy typically involves a mix of the major public cloud providers, such as Amazon Web Services (AWS), Google, Microsoft and IBM.

However, there are other cloud vendors that can be a good fit for specific needs, such as Oracle, whose cloud offerings include SaaS-based ERP systems and DigitalOcean, which offers a more developer-focused platform.